Part 1: The Smarter Way to Earn Fixed Returns

Let’s Start with a Familiar Scene

Think back to those visits to the bank with your parents.

They’d fill out a form, hand over a cheque, and walk out with a Fixed Deposit (FD) receipt.

Simple. Safe. Done.

For decades, FDs were the default investment choice.

No stress. No surprises. And honestly, for the time — it made perfect sense.

Back Then…

In the early 2000s, FD interest rates hovered around 9–11%.

So, if you invested ₹1,00,000 in a 5-year FD at 10%, you earned ₹50,000 in interest — with virtually zero effort.

Steady returns. Zero volatility.

But… Times Have Changed

Fast forward to 2025. Today’s FD rates range between 5.5% to 7.5%.

Now factor in inflation, which eats into your purchasing power at 4–6% annually.

Even with a 6.5% FD, your real return may barely keep pace with rising expenses.

It’s no wonder investors have started asking:

“Is there a better option than an FD — something secure, yet more rewarding?”

Enter: Bonds – The FD’s Smarter Cousin

Let’s be clear — bonds aren’t new.

Governments, corporates, and PSUs have long used bonds to raise capital.

What’s changed is access.

Today, investors like you can participate in the bond market — just like you would in an FD — but with the potential for higher returns and more flexibility.

So, What Exactly Is a Bond?

At its core, a bond is a loan made by you, the investor.

The borrower — a company, government, or PSU — promises to:

- Pay you regular interest (called a coupon)

- Return your principal at maturity

Bonds are typically issued in small denominations, making it easy for multiple investors to participate.

You receive a bond certificate — much like an FD receipt.

In essence, it’s similar to an FD, but with added features and potentially higher returns.

FDs vs Bonds: Same Same, But Different

| Feature | FD | Bond |

|---|---|---|

| Who you lend to | Banks, NBFCs | Companies, Government, PSUs |

| Returns | 5.5% – 7.5% | 7% – 10% (or higher) |

| Early Exit | Allowed, but with a penalty | Can be sold in the secondary market (if listed) |

| Security | Usually unsecured, but insured by DICGC up to ₹5 lakh per PAN per bank. |

Some bonds are secured |

| Risk | Very low | Low to moderate (based on issuer) |

Real-Life Scenario

You’re looking to invest ₹1,00,000 for 3 years.

FD Option

Rate: 6.5%

Returns: ~₹1,21,000 after 3 years

Bond Option

Corporate bond at 9%

Returns: ~₹1,29,500

That’s ₹8,500 more, simply by exploring a better alternative.

Why Are Bonds Gaining Popularity?

Historically, bonds were accessible primarily to HNIs and institutional investors due to high entry barriers.

But with digitization and financial innovation, minimum ticket sizes have dropped — making bond investing more inclusive than ever.

Here’s why bonds are gaining traction:

- Easy to buy via digital platforms

- Start with as little as ₹1,000

- Higher returns compared to FDs

- Regular interest payouts (like a salary)

- Great for portfolio diversification

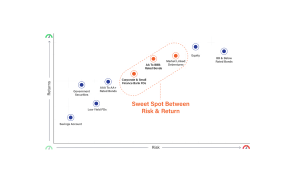

Should You Consider Bonds?

You might consider bonds if you:

- Seek higher returns than FDs

- Are comfortable with slightly higher risk

- Prefer fixed, predictable income

- Are investing for 1–5+ years

- Want to diversify beyond equity and FDs

Stick with FDs if you:

- Want near-zero risk

- Are investing for less than a year

- Don’t want to track or understand products

Final Thoughts

FDs have their place — especially for senior citizens, ultra-conservative investors, or short-term goals.

But for those seeking better yields without venturing too far into risk, bonds offer a compelling middle ground.

Some bonds even allow early exit via exchanges, offering flexibility that traditional FDs lack.

And no — you don’t need to be a financial expert to start investing in bonds.

Platforms like Bidd are built to simplify the process and make fixed income investing more accessible than ever.

So, the next time someone says,

“FDs are safe,”

You can confidently respond:

“True. But have you looked into bonds?”

Explore Fixed Income Investments — Learn and Invest Easily with Bidd

Disclaimer: This blog is intended solely for educational and informational purposes. It should not be construed as investment advice, a recommendation, or an offer to buy or sell any financial products. Please consult a registered financial advisor before making any investment decisions.